Secured vs Unsecured Personal Loans: What’s the Difference?

Did you know personal loans might be a great way to get some quick money? People use them for all sorts of things like paying off other debts, fixing up their houses, or even going on their dream vacation!

But guess what? Not all personal loans are the same.

They come in two main types: secured and unsecured loans. It’s super important to understand what makes these two different so you can choose the best one for you.

What are Secured Personal Loans?

Secured personal loans are like making a pinky promise with something valuable. You promise the bank that if you can’t pay back the loan, they can take your valuable thing. This could be your car, your house, or even your savings account! Here are a few things to remember about secured loans.

- You need to offer something valuable to get the loan.

- The value of your valuable thing determines how much you can borrow and what interest rate you’ll get.

- Secured loans usually have lower interest rates than unsecured loans.

- The most common types of secured loans are auto loans and home equity loans.

According to Bankrate, secured loans are often chosen by people who don’t have high credit scores because the valuable thing reduces the risk for the lender.

But hold up! Secured loans aren’t all sunshine and rainbows. They have some drawbacks.

- Imagine this: you borrow money and can’t pay it back. The lender could take your valuable thing.

- Getting this type of loan isn’t exactly a walk in the park. It might take longer and be a bit tricky.

- The amount you can borrow depends on how much your valuable item is worth.

Key Takeaway: Secured personal loans are a great choice for people who don’t have super high credit scores because the valuable item reduces the risk for the lender. But you need to be careful when taking out this loan, as if you can’t pay it back, they might take your valuable thing away!

What are Unsecured Personal Loans?

These are pretty cool because you don’t have to put anything up as collateral. This means if you can’t pay it back, no one is going to take your stuff.

But here’s the kicker: these loans are riskier for the lender. So they charge higher interest rates. That could mean you’ll end up paying more in the end.

Nobody likes to think about not being able to pay back a loan, right? But it’s always better to know the good, the bad, and the ugly when dealing with loans.

Here’s what’s cool about unsecured personal loans.

- No collateral is needed. Your property isn’t at risk if you can’t pay.

- The loans are flexible, which means you can use them for different needs.

- They are simple to understand.

According to a report by Experian, people who have good credit scores and steady jobs are the best candidates for these loans.

However, everything has a downside.

- Higher interest rates compared to secured loans.

- Loan limits may be lower since there’s no collateral to back up the loan.

- Tougher to qualify for these loans. You’ll need a high credit score and a low debt-to-income ratio.

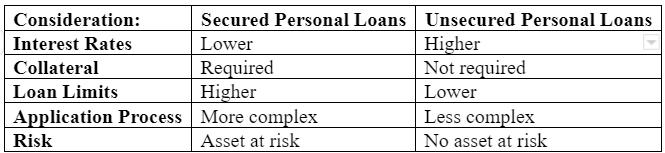

Comparing Secured and Unsecured Personal Loans

Comparing them is like comparing apples to oranges. They’re both fruits, but they taste different. Just like these loans, they’re both the money you borrow, but they work differently.

What’s The Deal with Interest Rates?

According to a report, the average interest rate for a secured loan is about 4.7%. That’s like buying four and a half candy bars for every 100 candy bars you borrow. But for an unsecured loan, it’s 9.41%! That’s almost ten candy bars! This happens because unsecured loans are riskier. So, before you decide, think about how many candy bars you’re willing to give away.

How Much Money Can I Borrow?

With a secured loan, you can usually borrow more money. That’s because you promise something valuable if you can’t pay it back. It’s like saying, “If I don’t give your toy back, you can have my toy.” But with unsecured loans, you can’t borrow as much. There’s no toy exchange promise, so they’re a bit more cautious.

How Do I Apply for These Loans?

Applying for a secured loan is like a treasure hunt. You need to show proof of your treasure (collateral) and sometimes even get it appraised. It’s a bit more work, but it can be worth it. On the flip side, applying for an unsecured loan is easier. It’s more about showing you’re good at managing money and having a steady income.

Are There Any Risks?

Yes, there are risks with both loans. If you don’t pay a secured loan on time, you might lose your treasure. So, think carefully if you can keep up with the payments. For unsecured loans, the risks are different. If you don’t have good credit, you might have to give away more candy bars (higher interest rates) or not be able to borrow much. So, make sure your credit score is good!

Key Takeaway: Secured and unsecured loans both have their merits and drawbacks. Secured loans typically offer lower interest rates and allow you to borrow more, but you run the risk of losing your collateral if you default on the loan. The application process can be more complex as it involves demonstrating and sometimes appraising your collateral. Unsecured loans, on the other hand, don’t require collateral and have a simpler application process, but they come with higher interest rates and may be harder to qualify for. It’s important to assess your financial situation, credit score, and risk tolerance before choosing between these two types of loans.

How to Choose Between a Secured and Unsecured Personal Loan

It all depends on your own money situation and what you want to do. Let’s go through some steps together.

First, let’s take a look at how much money you make and if it’s steady. Can you pay back the loan every month without any trouble? If you’re nodding yes, then a secured personal loan might work for you.

Second, have you heard of a credit score? It’s like a report card for how well you’ve managed your money. Great news! If you’ve got a high credit score, you’re in a sweet spot. You could get an unsecured loan with nice terms and low interest. But if your score isn’t quite there yet, don’t fret! A secured loan could be your ticket.

Third, think about why you need the loan. Perhaps you want to snag a new car or spruce up your home. In that case, a secured loan might be your best bet. This type of loan is connected to something you own, like your wheels or your crib. However, if you need the cash for various reasons and crave flexibility, an unsecured loan could be your jam.

Fourth, do some shopping! No, we’re not hitting the toy store or browsing video games. We’re talking about shopping for the best loan deal. Check out the interest rates (that’s the bonus cash you pay for borrowing) and payback period. Different lenders may have unique deals for both secured and unsecured loans. Think about how much the loan will cost you over time and decide which one is the cheapest for you.

Last but not least, if you’re feeling a little lost, it’s okay to ask for help. You can talk to a financial advisor. They’re like a coach who can guide you based on your own money situation and goals. They’ll be able to help you pick which type of loan would work best for you.

Key Takeaway: No matter what type of loan you decide to go with, it’s important to be aware of the potential risks and benefits. Carefully analyze your financial situation, credit score, and risk tolerance in order to choose the best option for your needs.

Final Thoughts

So, knowing the difference between them is super important when you’re picking the best one for you. Secured loans can offer you a bigger cash flow and lower interest rates. But be on your toes! If you can’t pay it back, you might lose something valuable like your car or house. On the other hand, unsecured loans don’t ask for any stuff as backup, but they have higher interest rates and might not let you borrow as much.

Consider how stable your income is and what your credit score is like. Also, reflect on the reason for needing the loan. Make sure to weigh all the details and risks for each loan type. Remember, it’s totally okay to tap into the expertise of a financial advisor if you need some guidance. No shame in asking for a little help!

Sorry, the comment form is closed at this time.