How to Budget with Biweekly Checks: a Step-by-Step Guide

According to data provided by the US Bureau of Labour Statistics, biweekly checks are the most common payment frequency. Many ask themselves if budgeting with a biweekly frequency is different than doing it with a monthly one.

This article will first give you an overview of general budgeting principles. Then, it will show how to budget with biweekly checks easily and effectively.

Classifying Expenses

Whether you are budgeting with biweekly pay or not, the first step consists of dividing your costs into fixed and variable expenses.

Fixed Expenses (AKA Regular Bills)

Fixed expenses are recurring costs that tend to be the same over time. They include:

- health insurance premiums

- rent

- phone, internet, and other utility bills

- monthly bus/metro pass

- membership (clubs, gym)

They are usually monthly bills and rarely change from month to month unless you negotiate new conditions on your loans, change utility providers, complete your studies, etc. Sometimes service providers will change their fees unilaterally and inform you in advance by email or letter.

Variable Expenses

In contrast, variable expenses are those costs that tend to change each month based on your consumption. Sometimes the change can be minor, while others it can be significant. These include:

- groceries

- personal care products

- pharmacy products

- entertainment (cinema, concerts, events)

- gas

These costs tend to vary as a result of lower or higher consumption. The more you use your car or go out with friends, the higher your variable costs will be.

Needs or Wants?

An additional classification that you can use to take more control of your finances is the one between needs and wants.

Needs are expenses that you can’t avoid. Examples are essential groceries, health insurance premiums, and heating. Of course, they can change from person to person. If you live in a remote area with limited public transportation, gas and car repairs are most likely a need. In contrast, those who live in an urban area can opt for a monthly pass for the local bus and metro.

As opposed to needs, wants are those non-essential expenses you decide to incur based on your personal choices and preferences. They include gym subscriptions, streaming TV, and leisure weekend activities.

While not strictly necessary for budgeting purposes, dividing costs into wants and needs allows you to determine which expenses are easier to sacrifice than others. For example, if you are trying to save money fast for your next Winter holiday, you can decide to cut some of your wants (Netflix subscription? Dining out?) for the next three months.

It’s important to notice that needs and wants can be both fixed and variable expenses. For example:

- health insurance premiums are a fixed need

- a gym subscription is a fixed want

- essential groceries are a variable need

- a concert ticket is a variable want

Use a Monthly Calendar to Keep Track of the Most Important Dates

Even if you are budgeting biweekly, it’s useful to have a monthly calendar where you can highlight the most important dates of the month. These include:

- the days on which you get your paychecks

- the days on which monthly fixed expenses are due (e.g., rent or gym subscription)

- the days on which debt payments are due (e.g., mortgage)

Your calendar should also include those days on which yearly payments are due. For example, if the payment for your computer antivirus subscription is due on August 10 of each year, make sure you write it in advance on your August calendar.

Also, it’s a good practice to add those dates for which you are planning significant variable expenses (whether you will your savings or not). For example, if you’re planning to go skiing from December 4 to December 6, you can add “Skiing trip” to your December monthly calendar.

Set Up Your Biweekly Budget

It’s now time to prepare your budget for each 14-day period. It consists of various sections.

1st Section: Biweekly Goals

Examples of biweekly goals are:

- putting aside a certain amount and adding it to the savings fund for a new bicycle

- putting aside a certain amount and adding it to your emergency fund

- spending less on non-essential groceries

- avoiding dining out

- selling your old laptop

Your goals will be determined by your priorities. Some people need to save money faster for an occasion, while others are trying to cut certain costs or generate an additional inbound cash flow.

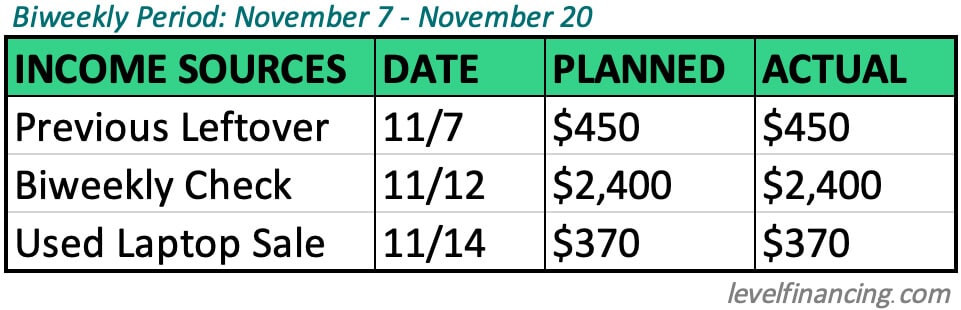

2nd Section: Weekly Income Sources

Create a table to list your income sources for the next two weeks. These include your biweekly check, any irregular income (like the money you can earn by selling your old laptop), and any leftover from the previous two-week period. Use a column for your expected income and one for the actual one (they are usually the same, but there may be exceptions).

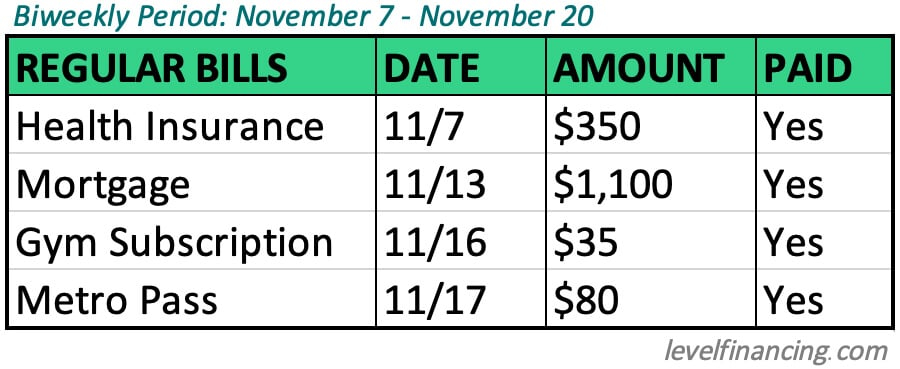

3rd Section: Biweekly Regular Bills

Use this table to list upcoming regular bills for the following two weeks. Mark them as paid after making each payment. When you budget biweekly, your regular monthly payments are usually spread over two (and sometimes three) periods. For example, your November health insurance premium may be due during the Nov 7 – Nov 20 period, while your phone bill may be due on the following biweekly period.

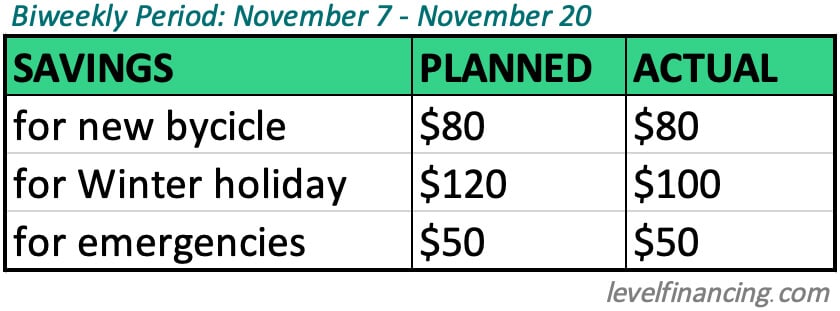

4th Section: Biweekly Savings

In this other table, you will list the money you plan to save by the end of the biweekly period. Add one column for the desired saved amount and one for the actual saved amount.

Note that savings shouldn’t be confused with leftovers. The money you save is usually put aside for a goal, like a future holiday or buying a motorbike. A leftover is what remains after subtracting both total costs and savings from your total biweekly income. This sum is transferred to the following biweekly budget, where it will be seen as part of your income.

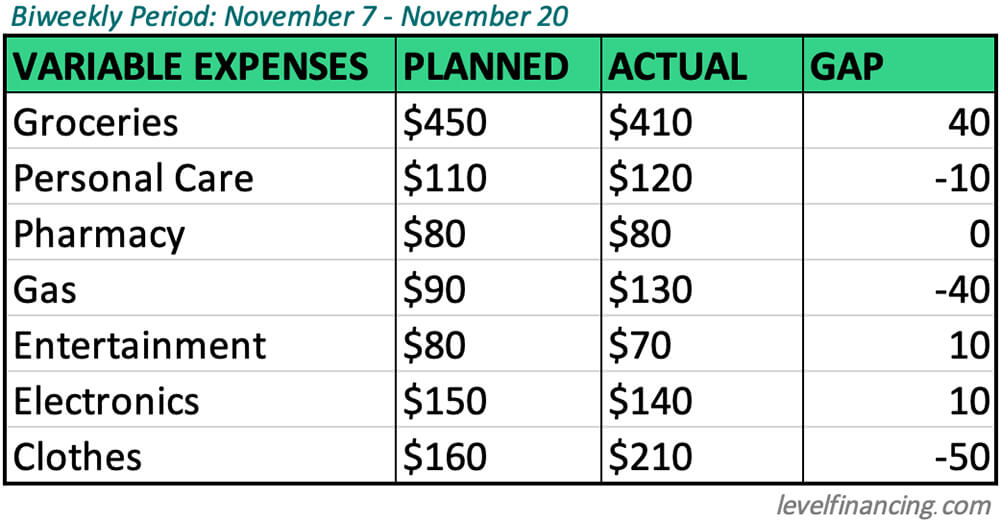

5th Section: Biweekly Variable Expenses

This table consists of a list of your variable expenses plus

- a column for the planned sum

- a column for the actual sum

- a column for the differences between the two

To know the actual sum for each biweekly variable expense, you need to track them and sum them (we’ll explain how in a second). The last column highlights the gap between your desired consumption of certain items (e.g., food or clothes) and your actual consumption behavior. This can help you in two ways:

- set more realistic sums for future biweekly budgets

- change your consumption behavior

As we said earlier, you need to track and sum your transactions on a biweekly basis to add them to the fourth table of the biweekly budget. To do so, you can create a 4-column expense tracker. The columns are:

- the date of each expense

- the description of each transaction (e.g., supermarket purchases)

- the variable expense type (e.g., groceries)

- the amount of each expense

By summing the biweekly expenses for each category, you obtain the total value for each expense, and you can add it to the previous table.

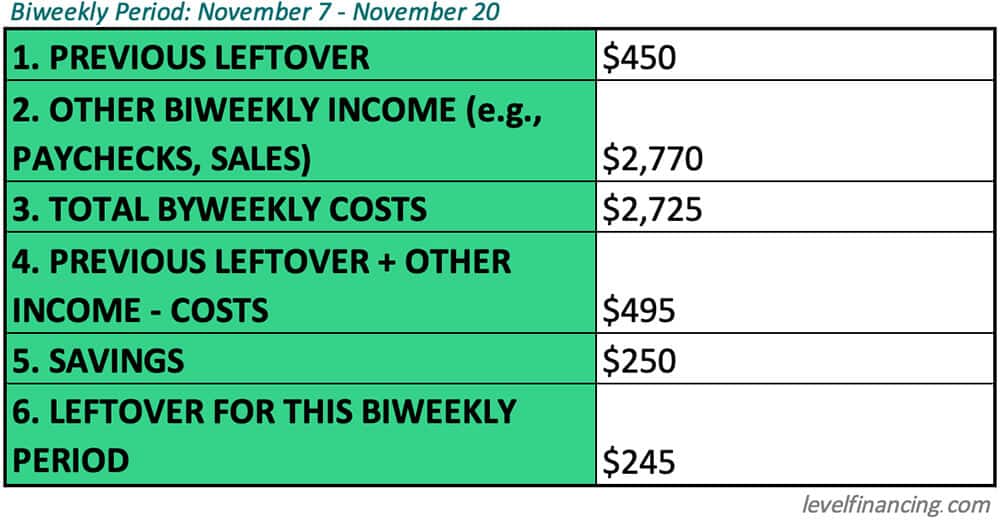

Biweekly Budget Summary

At the end of the two-week period, you will prepare your budget summary. Here is the content of each row.

- Leftover from the previous biweekly period

- Total biweekly income

- Total costs (both regular and variable)

- Sum 1 and 2. Then subtract 3.

- Your total savings

- Leftover for this biweekly period (the difference between 4 and 5)

Biweekly vs. ‘Twice a Month’

While this confuses some people, being paid every two weeks doesn’t always equal receiving your check twice a month.

Let’s say you get paid every other Monday. If your first check is on October 3, 2022, then you will receive three monthly paychecks in October and two monthly paychecks in November:

- Monday, October 3

- Monday, October 17

- Monday, October 31

- Monday, November 14

- Monday, November 28

Over the course of one year, there will be ten months with two paychecks and two months with three paychecks.

Additional Tips for Biweekly Budgets

Changing Dates for Regular Bills

If your regular bills are not spread evenly throughout the month, you can call one or more of your providers to try and move your due dates.

Let’s say your regular bills amount to $1900 a month. Yet bills for $1700 are concentrated in the second half of the month. You will have:

- a biweekly budget with only $200 in fixed expenses

- the following biweekly budget with $1700 in fixed expenses

In this scenario, you could contact your mortgage provider or your phone company and ask them to move your due dates to the first half of the month.

The same goes for situations where almost all regular bills are concentrated in the middle of the month. You can ask your service providers to move some due dates towards the first half of the month and some towards the second half.

Don’t See Your Third Paycheck as Extra Income

As we said earlier, there will be two months of the year in which you will receive three paychecks rather than two. Some people will be tempted to see this extra paycheck as some sort of bonus payment. However, it’s not wise to increase your variable costs during those periods. If the third paycheck results in higher cash availability, try to determine whether that cash can come in handy in future biweekly periods or can help you save faster for specific goals.

Paper, App, or Spreadsheet?

When looking for a budget planner, you can either use a paper version, or you can look for a biweekly budget planner app. Some people prefer creating their own budget planners by using spreadsheet apps (like Microsoft Excel, Apple Numbers, or Google Spreadsheets), as we did in our examples.

Sorry, the comment form is closed at this time.